paying taxes on fanduel winnings|Sports Betting Taxes: How to Handle DraftKings, FanDuel : Tuguegarao Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to . 123movies is still safe to use in 2023 and best site to watch free movies online. You can get almost any movies and show on 123movies. 0123movies updates all the latest movies and tv shows daily and only links to the video. 0123movie complies with DMCA and is a proxy which links to the content available online.

PH0 · What Taxes Are Due on Gambling Winnings?

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes on Sports Betting: How They Work, What’s

PH3 · TVG

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · How to Pay Taxes on Gambling Winnings and Losses

PH6 · How Much Taxes Do You Pay On Sports Betting?

PH7 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH8 · Effective Strategies to Handle Tax Withholding on FanDuel

Watch Leng Altura Video Scandal video on xHamster, the biggest sex tube site with tons of free Tight Pussy & Cowgirl porn movies!

paying taxes on fanduel winnings*******FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out . Learn how to report and pay taxes on your Fanduel winnings, whether you're a professional or casual gamer. Find out what counts as taxable income, how to .

Put it this way: If you won an equal amount of money at DraftKings and FanDuel (or any of its competitors), your winnings would be reported and taxed the .paying taxes on fanduel winnings Put it this way: If you won an equal amount of money at DraftKings and FanDuel (or any of its competitors), your winnings would be reported and taxed the . If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to . Explore the intricacies of reporting FanDuel winnings on your tax return, from understanding tax withholding to tracking losses. Learn how to accurately report . Key Takeaways. You're required to report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on your tax return. You can’t subtract the cost of a wager .

DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need to report your winnings even if you do not .

For instance, your winnings might be below these thresholds, but be mindful that you're supposed to pay taxes on anything you win.

Sports Betting Taxes: How to Handle DraftKings, FanDuel Every time bettors lose a $1,100 bet, they lose $1,100. But every time sportsbooks lose a $1,100 bet, they only lose $1,000. So if a bettor makes 10 wagers of $1,100 each and goes 5-5 on those .

Calculate tax payments on your gambling winnings free and easily with our gambling winnings tax calculator. Available for use in all 50 states. . These documents include tickets, payment slips, Form W . How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel . Form W-2G. Both cash and the value of prizes are considered “other income” on your Form 1040.If you score big, you might even receive a Form W-2G reporting your winnings. The tax code requires institutions that offer gambling to issue Forms W-2G if you win:. $600 or more on a horse race (if the win pays at least 300 times the wager .

Just check the app for the tax forms and see. Sports bets credit your losses against the wins. So if you won a $7k prize, but have wagered $5k, you will only be showing $2k as taxable income. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I..

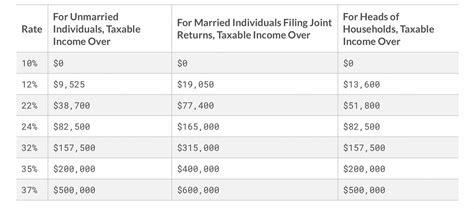

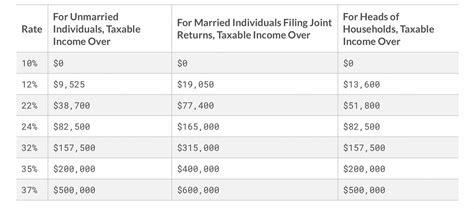

No. The tax implications differ considerably between these two categories. For professional gamers, Fanduel winnings are considered regular income. This means they’ll be subject to the same tax rates as any other earnings – ranging from 10% to 37% based on income brackets for 2021.Capital-Lobster. ADMIN MOD. Tax help- fanduel withheld 11,000$ in winnings. Hey guys- fanduel is refusing to help me out with this. Was hoping to see if anyone has any experience regarding this. I won a monster same game .

Looking to withdraw your winnings from FanDuel? We list all the options including the FanDuel instant withdrawal and the fastest way to withdraw your funds. . Paying Taxes On Your Winnings. If you have hit the jackpot and won a colossal parlay bet, and the total money generated is above what has been deposited, these funds are .

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through .

We would like to show you a description here but the site won’t allow us. Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your .Taxes Payable for FanDuel Sportsbook. In general, taxes on FanDuel Sportsbook winnings depend on the amount you have won and your overall taxable income. Any sports betting winnings over $600 (or if the amount is 300 times the original bet) are subject to a 24% withholding rate tax, which can be deducted from your winnings at the . Whether it's $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other income" on Schedule 1 (Form 1040). If .After you’ve received all your W-2G forms, you need to transfer your total gambling winnings from all sources and any amounts withheld to your income tax return. Simply add up all the amounts from Box 1 on all your W-2G forms and then list that total as “Other Income” on your Form 1040, Schedule 1. The same amount then goes on Line 7a of .

FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off-track betting, bingo, or slot machines; any winnings over $1200 from keno games; and, all winnings over $5000 from poker tournaments. It’s important to understand the . The 2021 calendar year is coming to an end, and it’s nearly tax time again in Tennessee. If you’ve participated in any sports betting this year, you might be wondering whether you’re required to report those winnings on your upcoming federal income tax return, due on April 15, 2022. The short answer is, yes. For the longer answer, keep .Income tax will automatically be withheld, just as it is from your paycheck, if your winnings total more than $5,000. According to Maryland law, prize winnings of more than $5,000 are subject to withholding for both federal and state income tax purposes. Maryland taxes will be withheld at a rate of 8.75 percent on a resident's winnings.

While FanDuel winnings are generally considered taxable income, not all winnings may be subject to reporting depending on the amount won and the frequency of your gambling activities. Amount won: As mentioned earlier, the IRS has set a reporting threshold of $600 for gambling winnings. If your total winnings from FanDuel in a tax year exceed .

Wir bitten dich, deine Daten zu verifizieren, damit wir sicherstellen können, dass deine Informationen und die mit deiner E-Mail-Adresse verknüpften Einkäufe sicher weitergeleitet werden.

paying taxes on fanduel winnings|Sports Betting Taxes: How to Handle DraftKings, FanDuel